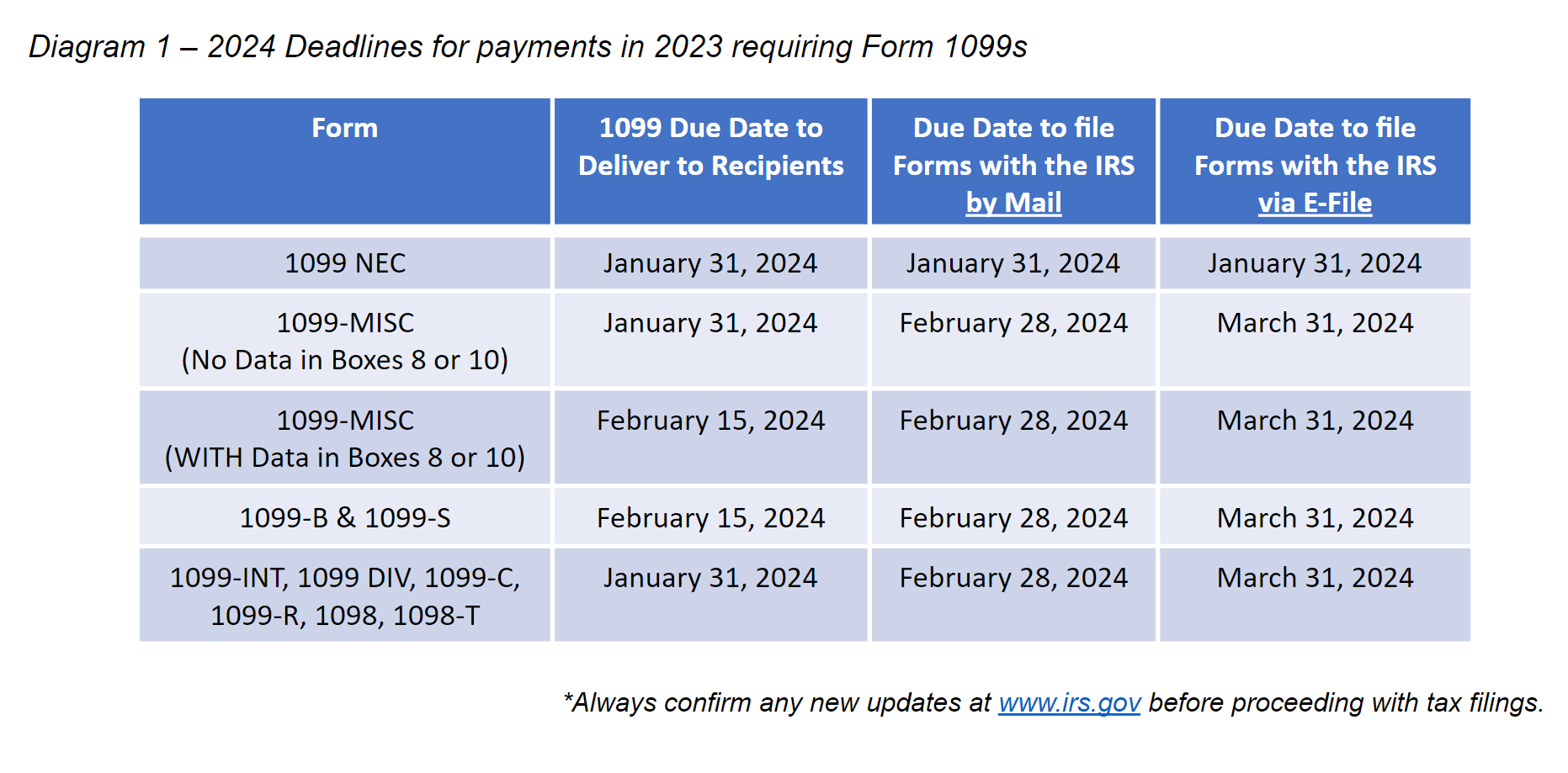

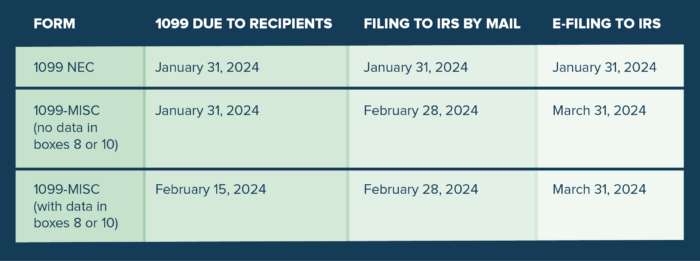

When Are 1099 Due To Recipients 2024 Form – It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . (Beginning January 2024, you will no longer be If so, see the “1099-INT” section above.) The form is due to recipients by January 31 (February 1 in 2021), but isn’t due to the IRS .

When Are 1099 Due To Recipients 2024 Form

Source : blog.checkmark.comWhen & How to file a Form 1099

Source : www.finaloop.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.comHow to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

Source : www.buildium.comIn Depth 2024 Guide to 1099 MISC Instructions BoomTax

Source : boomtax.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comWhen Are 1099 Due To Recipients 2024 Form How to File 1099 NEC in 2024 — CheckMark Blog: ROCK HILL, SC / ACCESSWIRE / January 31, 2024 / Nationwide, businesses employing both employees and independent contractors face tight deadlines for filing and distributing Forms W-2 and 1099-NEC, and . Residents of Maine and Massachusetts will have until April 17, 2024, due to state holidays and certain 1099-MISC forms must be sent to recipients by this date. The IRS has more details .

]]>

.jpg)